From 01 March 2020, the IRD will no longer accept cheques.

Developments in electronic payment methods and improved ease of online payments from your smartphone or tablet, means processing cheque payments has become a rather laborious task.

However old habits die hard, and a significant amount of people continue to use cheques – IRD alone received more than 430,000 cheques in the year ended June 2019. Although this is a large number, it represents just 5% of all payments to the IRD for the same period, and over time reflects a 20% year on year decrease in the proportion of cheque payments.

From 01 March 2020, the IRD will stop accepting payment by cheques, including cheques dated after 01 March 2020. If the IRD receive a cheque on or after this date, they will return it to you and charge you a late payment fee in addition to charging you interest on the unpaid tax due.

This will be a significant change for some clients, and one that might take some adjustment. The good news is that there are plenty of other payment options that are faster, cheaper, and more secure. You may like to talk to your bank about payment options.

Payment options are:

1. Pay online through your bank.

Please see your bank to setup “online banking” and they can show you how to pay your tax and bills online.

2. Pay online through myIR.

You need to register for a myIR account on the IRD website. Using this option you can pay using a credit card or debit card. If you have regular, variable tax bills, you can also set up a direct debit to authorise the IRD to take payment from your nominated bank account. You can make the payment immediately or set it up for a future date.

3. Pay in person at any Westpac branch.

You can make a payment over the counter at any Westpac branch by cash or EFTPOS only. You do not have to be a Westpac customer to use this option.

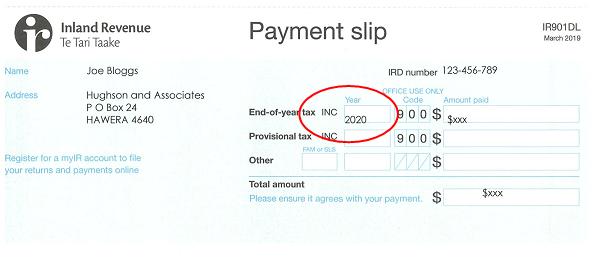

When paying your tax online or through myIR, please ensure that you are paying it to the correct tax type and the correct year end period. Both of these will be shown on the bottom of the notice you will receive from this office. The below is an example.

Please call us if you have any questions or concerns. We are here to help.